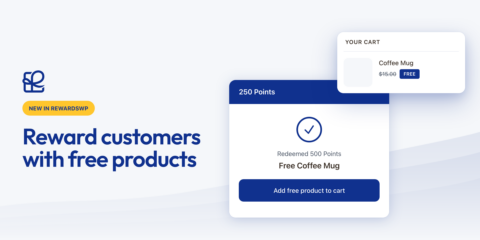

Reward Your Customers with Free Products, Not Just Coupons

Not every reward needs to be a discount. Now you can offer any product from your store as a loyalty or referral reward - customers claim it, add to cart, and it's free.

Continue Reading →

Not every reward needs to be a discount. Now you can offer any product from your store as a loyalty or referral reward - customers claim it, add to cart, and it's free.

Continue Reading →

A new year means new resolutions, new beginnings, and the end of the previous financial year. It also means there are some tax considerations for US-based affiliates that you may need to act on.

With 2017 in our rear view mirror, hopefully you can look back and find that it was a successful year for both you and your affiliates. Your relationship with your affiliates is a wonderful thing. The harder they work, the more money you both earn. It’s like having a sales team without the overhead of actually hiring them.

If you’re running an affiliate program in the United States, or have affiliates who reside in the U.S., that relationship can generate some tax filing requirements for you.

Generally, payments to affiliates are classified as non-employee compensation. Affiliates aren’t employees, so they don’t pay payroll taxes on the commissions paid to them. However, you are responsible for reporting the amounts paid to them to the IRS if it totals over $600 during the year.

As an affiliate program manager, there are a few things you may be responsible for in addition to paying your affiliates on time. If you have made payments totaling $600 or more during the year to any US-based affiliate, you will need to report those payments to your affiliates on IRS form 1099-MISC.

In order to fill out a 1099-MISC, you will need some basic information.

You must file any 1099-MISC form with non-employee compensation, including affiliate commissions, by January 31, 2018. Your affiliates should also receive their copies of the form by that date. Affiliates will need those forms to file their own income taxes in April. Getting the form to them in January will provide them with sufficient time to prepare their own taxes.

If you fail to file by the January 31st deadline, there can be significant financial penalties from the IRS.

Paper file

Yes, people can still paper file their tax forms!

If you are paper filing, you need to be filing fewer than 250 forms for the year. Anything more, and you’ll have to e-file.

In order to be able to paper file, you have to request special copies of the 1099-MISC form from the IRS. Those special paper version allows the IRS to scan the form into their system. That copy also uses a thin carbon copy paper, so a typical inkjet or laser printer may rip the paper when printing. Filing a paper version typically requires an old-fashioned typewriter or special printer.

A summary IRS form 1096 is also required if you choose to paper file.

E-file

E-filing is usually the preferred method for filing the 1099-MISC form. It reduces processing times and errors, so it’s probably the better alternative.

The IRS does not require a summary form 1096 when e-filing. That means less paperwork for you!

Also, you can upload one bulk file with all of your affiliate’s 1099-MISC information rather than manually preparing each form individually. This can save a lot of processing time on your end. When you e-file, the IRS will send a confirmation when the form is received and processed. With a paper filing, no confirmations are sent, so you may not be certain that it was received by the IRS.

Finally, the majority of states participate in the Combined Federal/State Filing Program. This program reduces processing time for you by allowing the IRS to automatically file with your state’s taxation agency. Not all states participate in the program though, so you may still need to file with them separately.

Regardless of how you file, you will still need to get the 1099-MISC forms to your affiliates. Many businesses prefer to send a paper copy to their affiliates. This is perfectly fine, even if you e-filed the form with the IRS. Mailing paper copies eliminates the chance of it being flagged as spam in your affiliates inbox.

If you choose to send your affiliates an electronic version, they must be able to consent to receiving it. If they don’t give this consent, they must still be able to receive a paper copy.

Your business may have unique tax considerations that may not have been covered in depth here. It is always advisable to consult with a local accountant who specializes in taxes to see if there is anything else you need to consider.

For example, your state’s filing deadlines could be different than what the IRS requires. They may even have different methods of filing altogether. Your accountant will be able to clarify whatever applies to your tax situation.

That last minute scramble to pull information together is a recipe for errors. Here are a few things to keep in mind to make sure you are prepared.

If you find yourself feeling unprepared for tax time, use these tips to get yourself back on track. You’ll thank yourself at this time next year too!

Disclosure: Our content is reader-supported. This means if you click on some of our links, then we may earn a commission. We only recommend products that we believe will add value to our readers.

Launch your affiliate program today and unlock a new revenue channel to grow your business faster.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Marketing cookies are used to follow visitors to websites. The intention is to show ads that are relevant and engaging to the individual user.

Your information is incorrect. The IRS says, it’s NOT your responsibility to issue a 1099-MISC if you go through a third-party payment processor like PayPal, Stripe, etc., to pay subcontractors which is what affiliates are.

It’s not up to you, as the business owner paying a contractor, to determine whether or not s/he meets the threshold. If you have been paying your contractor with PayPal or through another third-party processor, stay away from the 1099-MISC. You don’t need to send it to your contractor or to the IRS. You’ll save everyone time and energy in paperwork, and keep your freelancers and contractors happy because they won’t be stuck fighting with the IRS.

Would you mind sharing a link to the IRS guidelines on this?

This is absolutely spot on. No need to pursue this plugin! —

According to the IRS Instructions for Form 1099-MISC, “Payments made with a credit card or payment card and certain other types of payments, including third-party network transactions, must be reported on Form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC. See the separate Instructions for Form 1099-K.”

In short, PayPal will issue Form 1099-K to your contractor. So you do not need to send Form 1099-MISC.

If you are going through a third-party affiliate software and paying through PayPal, do you still need to collect the affiliates W-9s?

Hi Scott,

Thank you for trying to help Affiliate WP users with this article. I appreciate it.

There’s something the article doesn’t explain. Upon what legal theory is it believed that US laws apply extra-territorially, to entities which have absolutely no US presence/establishment?

I understand that the US is free to *assert* that its laws apply to anyone in the world who does business with a US citizen. But what actually backs up this assertion? Through what mechanism does the US claim to possess such powers, and (more pertinently) how does it demonstrate the power to enforce these assertions?

To put it more sharply… if a non-US entity, with no physical or legal presence in the US decides to say “I don’t care what the American government says about its bureaucratic requirements, because I am not one of its citizens, and have no presence in any of its territories”, then what then?

Or perhaps more pithily – no taxation (upon our time!) without representation??

A silly example trying to create reductio ad absurdum: If Vietnam passes a law that says that any server worldwide sending network packets into its territory (e.g. replies to a “ping”) is taxable under Vietnese law together with a mountain of compliance paperwork, then will US businesses feel that they should comply with that?

David

Hey David, great question!

The US has tax treaties with many countries around the world, which allows for a reciprocal enforcement of US and [fill in the blank country name]’s tax laws.

As far as I understand it, that’s how the EU countries can enforce their VAT laws outside their borders.

I don’t know off the top of my head which countries this applies to, but I would imagine it is fairly widespread. You can check with a local tax expert to clarify what applies in your particular situation.

I’m not saying I agree with this, but it’s unfortunately the reality. I’m totally on board with the no taxation without representation stance too. Let me know which harbor the tea is getting tossed into and I’ll be there 😉

Hi Scott,

Thanks for getting back. It’s interesting that you mention EU VAT, as AFAIK, affiliatewp.com doesn’t charge VAT to EU customers, and so presumably doesn’t remit what it “should have” (according to the EU) have collected to the EU.

My guess (as the author of an EU VAT plugin for WooCommerce) is that reciprocal/mutual enforcement is the long-term aim of various governments which have been passing these sorts of VAT laws, but I’m not aware that it’s actually a reality anywhere yet. (I can’t account for why so many governments as passing these laws otherwise – i.e. I don’t see what Tanzania, etc., really plan to achieve by passing such laws, unless there’s a long term plan to allow actual collection).

David

For full disclosure, I don’t work for AffiliateWP so I can’t speak to how they handle EU VAT. Nor would I publicly disclose that on a blog comment even if I was privy to that information 🙂

My guess though is that if EU countries are enforcing these laws (I don’t know for sure that they are or are not), they’ll target the higher volume offenders first. So an Amazon sized company would be much more likely, in my opinion, to be investigated for not paying the proper VAT amount than a small company with a few hundred dollars of sales.

I could be wrong though and who knows we may see more enforcement in the near future.

Hi Scott,

Amazon have physical presence in the EU. Hence, discussions about extra-territorial jurisdiction don’t have any relevance to them.

David

Does this apply if you paid out in store credit only? I don’t have any affiliates that earned $600 credit. Just wondering for those of us that pay in credit.

Hi Shay,

I believe in this situation, this would be considered bartering. According to the IRS, bartering is “…the exchange of goods or services…An example of bartering is a plumber exchanging plumbing services for the dental services of a dentist”.

In your case, you’re exchanging store credit for the service of promoting your products in the affiliate arrangement.

According to the IRS, “Persons who don’t contract with a barter exchange or who don’t barter through a barter exchange but who trade services, aren’t required to file Form 1099-B. However, they may be required to file Form 1099-MISC, Miscellaneous Income.”

In this case, I’d say yes this still applies to your situation, however if you have specific questions about how your business operates, I’d suggest you contact a local tax expert.

Further reading: https://www.irs.gov/taxtopics/tc420

Do you only create a 1099 if they made over $600?

Yes, that is correct.

For anyone that comes to read this article:

Please scroll down to the bottom of this article outlining payments made to contractors or vendors through PayPal or by credit card do not need to be reported:

https://www.leaddyno.com/report-affiliate-income-irs-1099s-forms/

I spent a little over 5 hrs verifying this through multiple sources. The above article is merely a clean rundown of the information.

Thanks Dusten. You’d think the author of this article might acknowledge this since it’s been mentioned in the comments 3 times.